Donation Spreadsheet For Taxes

Adding the additional business expenses saved Joe over 1500 in taxes. Add your own info and speak to data.

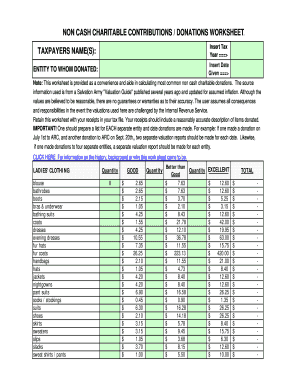

Non Cash Charitable Contributions Worksheet 2021 Fill Online Printable Fillable Blank Pdffiller

When youve added all the necessary information to your invoice save the completed spreadsheet to your computer.

. Aenean elementum erat at aliquet hendrerit elit nisl posuere tortor id suscipit diam dui sed nisi. Read this invoicing guide to learn all the information businesses should include on their invoices. Then you can also use it to keep track of.

The Document Foundation Purpose. Referred client must have taxes prepared by 4102018. You will most likely report the income from your 1099s on Schedule C Profit or Loss from BusinessSince Uber reports this income information directly to the IRS you dont have to include the actual 1099 forms with your tax return.

Donation value guide for 2021. Do your own research online. Lorem ipsum dolor sit amet consectetur adipiscing elit.

Volksbank Pforzheim eG Westliche-Karl-Friedrich-Str. 1 This assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20 and the Medicare surtax of 38 and that the donor originally planned to sell the stock and contribute the net proceeds less the capital gains tax and Medicare surtax to charity. If your donation is worth less than 250 the charity must give you a receipt showing its name and address date and location of donation and a reasonably detailed description of the property donated.

To deduct more than that the business owner has to itemize deductions on Schedule A. Use it to track all the charitable donations made in your organization. Youre compounding dollars that would otherwise be taxed Ringquist said.

Keep your donation receipts. If you choose to take the standard mileage you can claim 585 cents per mile during 2022. If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form.

3497390 Bank Code. Very carefully confirm the content of. If you plan to create your own template make sure to.

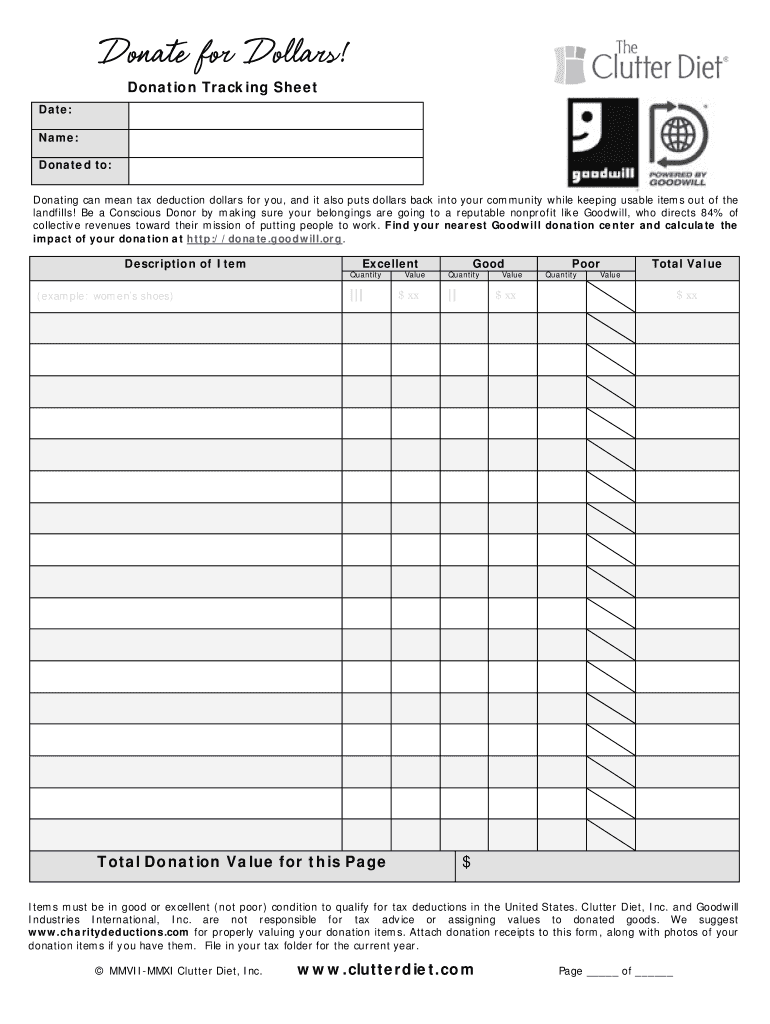

Use your indications to submit established track record areas. You can use a donation chart tracker or even a fundraiser thermometer template. You need every dollar you can get.

The maximum limit is of 15 lakh on interest payments of a home loan for a self-occupied house. The bottom line is a donation tracking template will make your life a lot easier. Any of these will serve the same purpose and give the same benefits.

Claiming mileage or gas for taxes depends entirely on your personal situation. Morbi sollicitudin massa vel tortor consequat eget semper nisl fringilla. The eligibility is 50 or 100 of the donation amount subject to an overall ceiling of 10 of your gross total income to certain funds and charitable institutions.

All Practical Spreadsheets are easy to use and have pre-defined print areas. Ask for a receipt preferably an itemized one before you leave. Do check how watchdogs like Charity Navigator CharityWatch and the Better Business Bureaus Wise Giving Alliance rate an organization before you make a donation and contact your states charity regulator to verify that the organization is registered to raise money there.

Using Schedule C. Make sure that you enter correct details and numbers throughout suitable areas. Return must be filed January 5 - February 28 2018 at participating offices to.

There is no ceiling on the amount. On the site with all the document click on Begin immediately along with complete for the editor. Available at participating offices and if your employers participate in the W-2 Early Access program.

Section 24Home loan interest payment. Save it as a xlxs format document so you. DE12 6669 0000 0003 4973 90 BIC.

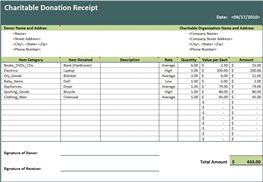

The total amount due for the invoice including applicable taxes. Below are FREE charitable donation spreadsheets. A donation receipt template should comply with particular requirements when it comes to the information it contains.

If youre behind on retirement savings dont bypass this tax benefit. MMB is authorized to establish administrative. Contributions to a 401k offer an upfront tax benefit because the money comes out of your paycheck before taxes which reduces your taxable income.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. We are an independent advertising-supported comparison service. Usually thats enough to take care of your income tax obligations.

The Document Foundation Kurfürstendamm 188 10707 Berlin Germany Address of bank. You can transfer a donation to our bank account Owner. In the August version of the 2023 Illinois Crop Budgets wheat plus double-crop soybean is projected to be much more profitable than stand-alone corn and stand-alone soybeans in southern IllinoisWheat-double-crop-soybeans has a much smaller advantage in central Illinois.

Most also include comments to aid in data entry. The Federal Trade Commission FTC recommends. When you donate items dont just drop them off at the donation center.

If these spreadsheets do not meet your needs consider a Custom Spreadsheet solution. VBPFDE66 Address of recipient. Starting with 2020 returns taxpayers can claim up to 300 of cash contributions as an above-the-line deduction on Form 1040.

To qualify the donation must be made to a qualified organization. HR Block employees including Tax Professionals are excluded from participating. Farmers considering adding wheat into their rotations should consider pricing some of the wheat.

Moreover you can only issue a donation receipt under the name of the individual who made the donation. Curabitur ac sagittis neque vel egestas est. For the 2021 tax year you can deduct up to 300 of cash.

How to complete any Donation Value Guide Spreadsheet online. 2 Total Cost Basis of Shares is the amount of money you have invested in the shares of a. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes.

To claim tax deductible donations on your taxes you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. You should include this information to make your document useful and official. Valid for 2017 personal income tax return only.

Our goal is to help you make smarter financial. The Vacation Donation to Sick Leave Account program Continued Salary allows all state employees to donate up to forty hours of accrued vacation leave each fiscal year to be converted to sick leave that may be used by one or more critically ill state employees who have applied to receive assistance through the program. Phasellus pulvinar faucibus neque nec rhoncus nunc ultrices sit amet.

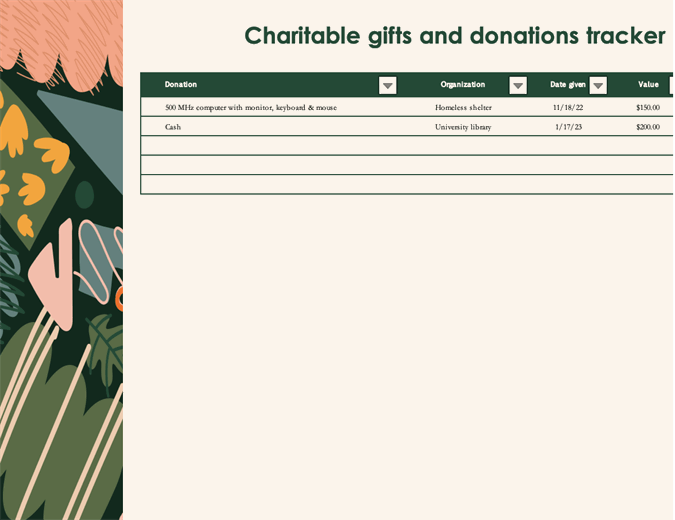

Charitable Gifts And Donations Tracker

Donation Value Guide 2021 Spreadsheet Fill Out And Sign Printable Pdf Template Signnow

Donation Calculator Spreadsheet Inspirational Goodwill Values Tax Golagoon Donation Tax Deduction Tax Deductions Spreadsheet Template

![]()

Charitable Gifts And Donations Tracker Template Excel Templates Charitable Gifts Donation Letter Donation Form

Printable Donation Form Fill Online Printable Fillable Blank Pdffiller

![]()

Donation Tracking Template Free Download Ods Excel Pdf Csv

Donation Sheet Template 9 Free Pdf Documents Download Free Premium Templates